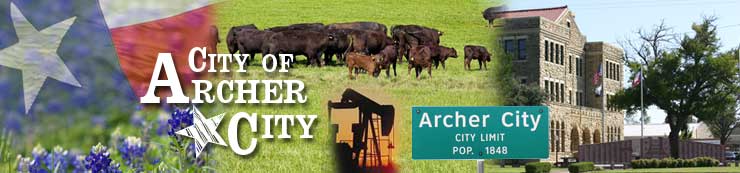

Welcome to the official website of the City of Archer City. Archer City is 25 miles southwest of Wichita Falls, lies at the junction of State Highway 79 and State Highway 25, and is the county seat of Archer County. We are a quaint Texas town that enjoys our “small town” feel and friendliness but also offers some finer aspects of city life.

Many know of Archer City because of our famous native son, Pulitzer Prize winning author, Larry McMurtry. Movies based on his novels, The Last Picture Show and Texasville, were filmed on the streets of Archer City.

Ranching and oil are two major industries in our area. Archer County is known as the “Short Grass Ranching Capital” of the nation because our grass, which is short, has tremendous strength and nutritious qualities. We are also known for excellent hunting. Our area is home to deer, dove, quail, turkey, and wild hogs.

City of Archer City, Texas -- (940) 574-4570

118 S. Sycamore, PO Box 367

Archer City, TX 76351

All images and content on this website are the property of the City of Archer City,

and may not be reproduced or duplicated without the written consent of the City Secretary.

This page was last updated: January 15, 2026

The City of Archer City encourages water conservation. Click here to view 10 easy water conservation tips.

The City of Archer City has initiated Stage 1 - Drought Watch of the Drought Contingency Plan effective November 10, 2022. Click here to view current water restrictions.

Archer City Visitor Center Mural

BULLETIN BOARD

Archer City Council Meeting

Thursday, January 22, 2026

6:30 PM

4-B Meeting

Wednesday, January 21, 2026

6:00 PM

Municipal Court

Wednesday, January 21, 2026

2PM

Archer City Municipal Court

Information

Click on the link below to set up your online account to view your utility bill and/or make a payment.

Walsh Park

Archer City Visitor Center

103 N. Center

Archer City, Texas 76351

COVID-19

2024 TAX RATE

THE CITY OF ARCHER CITY HAS ADOPTED A TAX RATE THAT WILL RAISE MORE TAXES FOR MAINTENANCE AND OPERATIONS THAN LAST YEAR'S TAX RATE. THE TAX RATE WILL EFFECTIVELY BE RAISED BY 8.68 PERCENT AND WILL RAISE TAXES FOR MAINTENANCE AND OPERATIONS ON A $100,000 HOME BY APPROXIMATELY $53.32.

Public Notices